Your Cart is Empty

Russia: the new blood diamonds

Does the jewelry you're buying help finance Russia's war against Ukraine?

In the past, the term ‘Russian gold’ meant the gold is rose gold. But nowadays, Russian gold and diamonds can only mean they’re mined in Russia, now leading the war against Ukraine.

As the world watches the atrocities taking place in Ukraine, knowing where your gemstones and precious metals are sourced is more important than ever.

If you only have a few minutes, these are the four major takeaways of how Russian gold and diamonds might help finance the war in Ukraine:

2.

Major trading countries like India, Belgium, China and the United Arab Emirates continue to trade with Russia.

3.

Russian diamonds are still considered conflict free by the narrow terminology used by the Kimberley Process, meaning they can still be traded legally.

4.

Despite sanctions, Russian diamonds can be imported as Indian goods or Belgian goods if they’re polished there.

Russia is responsible for a third of the world’s diamond supply - over 90% of which are mined by Alrosa (watch this name).

As financial sanctions against Russia prevent it from accessing most of its assets, Russia is turning to its gold and diamond reserves to finance their military aggression against Ukraine.

That's right, Russian diamonds are now blood diamonds.

When there’s obvious secrecy among jewelry industry leaders who might be covering footprints by Russian jewelry traders, there’s something juicy to uncover. Let’s spill the juice.

How Russian gold ends up in your jewelry

Many countries, including the USA and the UK, have placed sanctions for trading with Russia. But in practice, Russian gold is still entering Western markets, thanks to a hard-to-police global web of middlemen.

Recycled gold is under scrutiny, because it may contain gold of Russian or other dubious origin. It’s easier than it should be for scraps to be turned into recycled gold and become de facto responsible Chain-of-Custody certified gold.

The NGO Swiss said said a jump in Swiss gold imports from Dubai in March raised questions over whether Russian gold was finding its way via Dubai. The CEO of a major Swiss gold refinery confirmed it’s safe to assume gold from Russia ends up in western supply chains via Dubai.

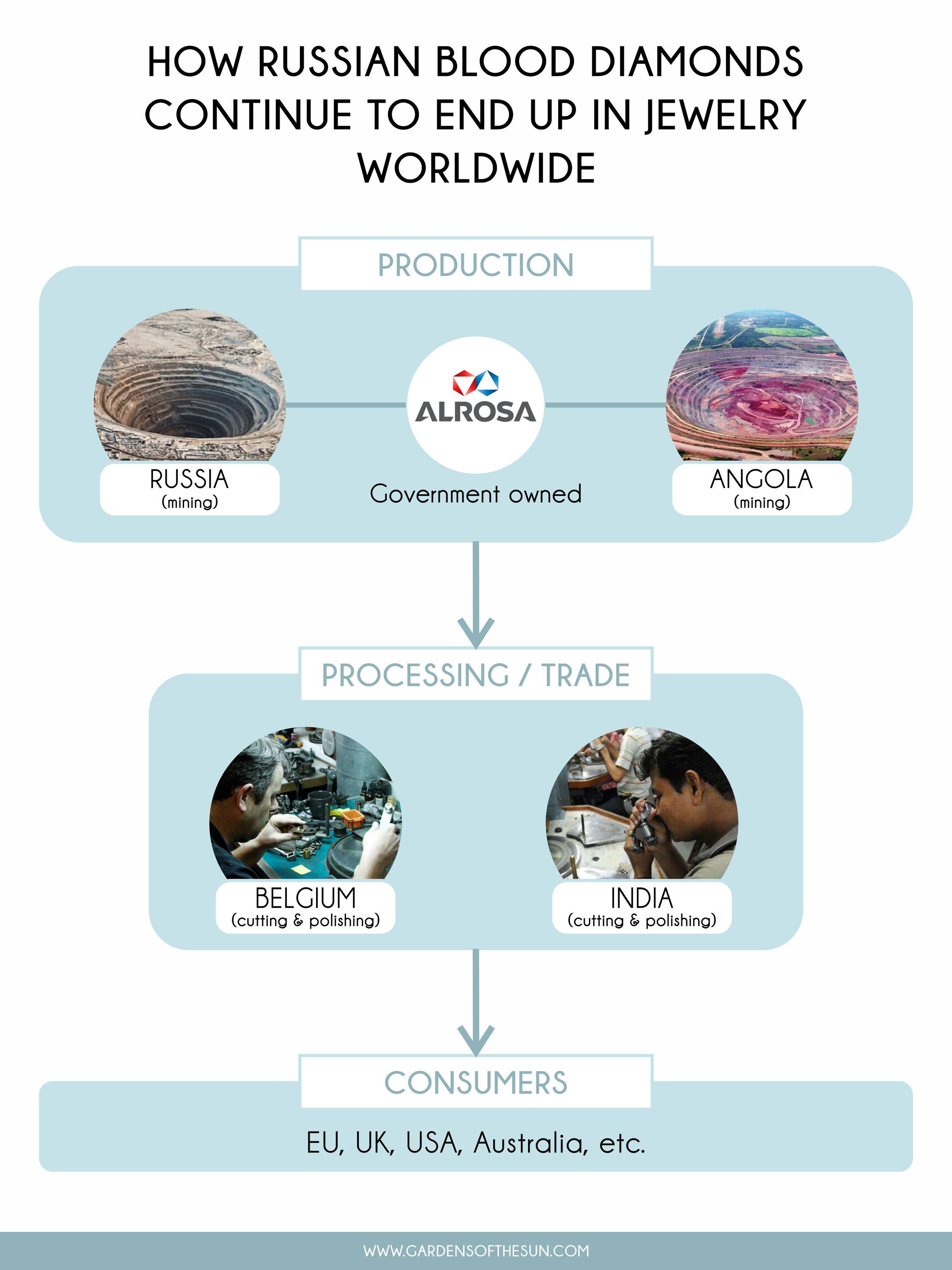

How Russian diamonds end up in your jewelry

When major jewelry trading countries are still supporting Russia, evading the label ‘Russian gold’ or ‘Russian diamond’ is actually not very difficult. So in practice, Russian diamonds are still entering jewelry supply chains. Let me explain how Russian diamonds can easily and legally circumvent sanctions through hubs like India and Antwerp.

Russia’s diamond supply chain consists of roughly four parts:

1.

Mining

(in Russia and Africa)

2.

Trading

(within Russia, in the largest diamonds hubs Belgium, India and UAE, and to a lesser extent also Israel and China)

3.

Cutting and polishing

(mostly in India)

4.

Retail

Major jewelry producing and trading countries, including China, India and the United Arab Emirates (UAE), voted against or abstained from voting on the United Nations General Assembly condemning Russia’s invasion of Ukraine. This means these countries don’t have sanctions against Russia. This offers the opportunity to import Russian gold and stones, polish them or use them to create jewelry, and then export them to other countries. This way raw materials from Russia can be transformed, no longer fall under sanctions and enter markets like the USA, the UK, Canada and New Zealand legitimately. And as long as Russian diamonds are labeled “conflict free” (more on this later), India can continue to import these diamonds freely.

Here’s what the supply chain loophole looks like right now. Russia exports its rough diamonds to India, where they are cut and polished. Then, processed diamonds and finished jewelry are exported as an Indian product, not a Russian one. US customs considers cutting gemstones or turning gold into gold jewelry a “significant transformation”. Meaning they could be brought into countries like the USA legitimately, even if the raw materials originally came from Russia. So polished diamonds can be legally imported as an Indian product, not a Russian one.

The true origin of gold and diamonds can be hard to discern when they travel through so many hands and countries. It also offers jewelers the opportunity to easily and legally circumvent sanctions by buying Russian stones processed through India. Or Belgium. Or China. Or UAE.

Even if it’s legally traded as Russian diamonds, these gems don’t fit the industry’s (KP) narrow definition of “conflict diamonds”, which refers to diamonds used to fund rebel groups. But these diamonds clearly fit the spirit of the term.

Watch this name: Alrosa

You’ve probably heard of De Beers, the largest diamond producer by revenue. Alrosa is a competitor of De Beers, and the world’s biggest diamond producer by volume.

Alrosa is the main player in the Russian diamond mining industry. It’s one third owned by the central government and another third by regional governments.

Alrosa’s human rights violations go way back. And they happened not just in Russia, but in Africa. Alrosa has a 41% stake in the Catoca mine in Angola, one of the world’s largest diamond mines, producing over 7 million carats of diamonds, worth USD 800 million, each year. In 2021, a massive tailings leak at the Catoca mine impacted aquatic life and took 12 lives in the neighboring Democratic Republic of Congo (DRC). Little action has been taken to address the water contamination that hundreds of thousands of people depend on.

Alrosa is also the majority owner of Luaxe, another Angolan diamond deposit valued at $35 billion. Moreover, Alrosa has signed deals with Zimbabwean and DRC’s state-owned diamond mining companies for joint exploration and production.

In short:

there’s little transparency around the exact amount Alrosa contributes to the Russian war chest, but there is an undeniable link between Alrosa and the funding of the Russian regime.

Russian oligarchs

It’s often said:

follow the money. In this case, the same goes for people’s names. Because Russia’s gold and diamonds are controlled by Russian oligarchs, it’s not so hard to trace the connection between the jewelry industry and Putin’s war.

The five largest diamond mines in Russia are owned by Polyus, Kinross Gold and Nordgold.

1.

Up until the family was sanctioned, Polyus was majority owned (76%) by the Russian oligarch Suleiman Kerimov and his family. Kerimov has been subject to US sanctions since 2018 for being a Russian government official, and sanctioned by the UK government and the EU this year on account of being a member of the inner circle of oligarchs close to Putin.

2.

Kinross is a Canadian based mining company with Van Eck Associates, Black Rock Inc. and Renaissance Technologies Corp as its largest shareholders.

3.

Nordgold is majority owned by the now sanctioned steel tycoon Alexei Mordashov and his family. The Panama Papers and Pandora Papers found that Mordashov contributed generous amounts to Putin’s associates and to fund Putin's pet projects.

How Russia’s diamond industry is linked to war

Russia generates money from diamonds not only as a shareholder, but also as a diamond trader. The state-owned Gokhran buys and sells diamond production from Alrosa, as well as metals like gold, to manage global supply and pricing.

Although the Russian diamond industry provides an important source of revenue, it’s considerably less than what Russia gets through its oil and gas exports for instance. For example, in 2021, the EU imported an estimated € 99 billion of Russian energy. Yet, the diamond industry is still a lucrative way to fund government operations, presumably including the military.

Certification systems failing

Fun fact:

Did you know Alrosa was part of the Responsible Jewellery Council’s Board? Yikes, I know. While by now Alrosa has stepped down from the Board, it remains a member and has kept its “responsible” certification.

The Kimberley Process (KP) was set up in 2003 in the wake of devastating civil wars in Angola, Sierra Leone and Liberia, which were largely financed by the illicit diamond trade, as an international effort to keep diamonds connected to conflict out of the supply chain. It operates under a UN mandate and includes all major diamond mining, trading, manufacturing and consumer countries, along with industry and civil society observers. All countries participating in the scheme must meet certain minimum requirements to ensure no conflict diamonds enter the legitimate trade.

At the time of writing, the KP has issued no public warnings on Russian supply. It’s unlikely the KP will take any action on Russian diamonds in the near future, for four reasons.

Now bear with me, as the four reasons work together.

The first shortcoming is the narrow definition of conflict diamonds. Objectively, Russian diamonds are conflict diamonds: they’re funding an armed conflict against a neighboring country. However, Russian diamonds don’t fit the narrowest definition of “conflict diamonds” used by the KP, which refers to diamonds used to fund rebel groups only. Officially labeling Russian diamonds “conflict diamonds” would require widening the definition.

Several KP member countries and the KP Civil Society Coalition have been calling for such a change for years. Prior to a crucial KP meeting of diamond producers in June 2022, Ukraine proposed to widen the definition of "conflict diamonds" to include government actors. It also proposed to expel any member country infringing on another member's sovereignty by majority vote. However, these discussions were removed from the draft agenda of the meeting after objections from Russia, Belarus, Central African Republic (CAR) and Kyrgyzstan. So the second reason is that the complications of the Russian invasion in Ukraine isn’t even up for discussion at the KP.

This brings us to the third reason, which leads to the first and second shortcomings. Decision-making in the KP is based on consensus. This means a decision can only be taken if every single participant agrees. This consensus also goes for organizing a meeting, like the Extraordinary Special Session dedicated to the financing of Russia's war against Ukraine, that the KP Civil Society Coalition has called for. Even if Russia didn’t participate in decision-making, several KP member states would be unlikely to agree on excluding Russian diamonds from the KP.

The fourth obstacle is the power Russia holds within the KP. Russia chairs two KP working Committees most likely to take action on this matter - the Committee on Participation and Chairmanship (CPC) and the Committee on Rules and Procedures (CRP). Britain, the European Union and the United States have asked Russia to step down from its Chairman position, but to date, Russia continues to chair these committees.

The countries that objected to the discussion about labeling Russian diamonds as conflict diamonds, have close political ties with Russia. For example, Russia recently deployed military contractors to Mali to help the government fight Islamic insurgents and has advocated for CAR to lift partial restrictions on its rough diamond exports.

How the KP continues to legitimize the flow of Russian diamonds (one third of the global supply) with conflict-free certificates affects the reputation and credibility of this regime. Or as the KP Civil Society Coalition stated in the June 2022 meeting, “the fact that the Kimberley Process (KP) is unable to even discuss whether it should continue certifying Russian diamonds as conflict-free, reaffirms what we have been denouncing for years: that the world’s conflict diamond scheme is no longer fit for purpose.”

Why is it so hard to ban Russian diamonds?

Decisions about boycotting diamond-producing countries are complex, with millions of international jobs and livelihoods depending on the flow of diamonds. With Alrosa out of the game, diamond cutters, polishers and traders are having difficulty sourcing stones. Gujarat, India's diamond polishing hub in Surat, is already seeing a reduced supply of raw diamonds. Large cutting facilities are cutting down to just 3-4 days of work, and smaller ones shutting shop. Sanctions can have a significant impact on the diamond business beyond Russia alone.

A ban on the trade in Russian diamonds - removing a third of the global supply - will endanger many Indian and Belgian jobs in the diamond trading and polishing industry in the short-term. Sources within the Belgian government believe sanctions on the diamond trade would hurt Europe more than Russia, with a quarter of EU’s diamonds coming from Alrosa, and a ban simply forcing the industry to relocate to another country, like India. As a result, the EU is still importing Russian diamonds.

Even if in the long run, it’s a positive drive for change to improve transparency and traceability in the diamond and jewelry industry.

You’re probably wondering if De Beers can’t just sell more diamonds. However, De Beers doesn’t produce many of the smaller diamonds Alrosa is known for.

Diamond prices have been going up since the war began. Faced with increased costs, jewelers may care about price more than origin. Some jewelers, like Tiffany & Co. and Signet Jewelers, have stopped buying new diamonds mined in Russia. However, Belgian and Indian traders are still buying diamonds from Russia. There’s obviously a concern for Russian diamonds to be passed off as diamonds of different origin, as is already happening with other conflict diamonds. With Russian production being more geared towards smaller diamonds, it becomes even easier to mix or confuse their origin.

What about Russian diamonds already in circulation?

The situation with Russian diamonds is that they really became conflict diamonds overnight. What happens with Russian gold, diamonds and gemstones already in circulation?

Most jewelers don’t know or don’t mention the exact origin of their gold or diamonds. So for many jewelers, little will change other than increased prices of gold and diamonds. They might not know their jewelry contains Russian stones or gold, and in turn, also not be able to tell you.

Since November 2018 Gardens of the Sun only purchases diamonds and gemstones from known origin. This includes a few diamonds, citrine and topaz purchased in 2019 and 2020.

We decided to use our Russian gemstones and diamonds for a dedicated sale, and donate 25% of sales of the jewelry using these stones to the Ukrainian organization Sylni. This charitable foundation helps survivors of wartime sexual violence, whether it's medical expenses, psychological support or legal assistance.

What Gardens of the Sun is doing

Never has it been more important to exercise due diligence and maintain meticulous documentation around gold and diamond purchases. We set up our systems well before the war started. And we continue to raise the bar on supply chain transparency.

1.

No diamonds or gemstones purchased from Russian origin since mid 2020.

2.

Only purchase diamonds from known origin since November 2018.

3.

Reduce our purchases of diamonds cut in India, where diamonds from Russian origin may be mixed in with diamonds of other origin.

4.

We don’t call diamonds ethical unless we know for a fact no harm took place in the communities that mined or cut that stone. The term conflict free as used by the Kimberley Process, is based on a narrow definition that still allows Russian diamonds to be labeled conflict free. So the term conflict free diamonds can mean entirely different things in the same industry.

5.

Continue to educate ourselves around issues in the diamond industry.

6.

Support diamond mining communities outside of Russia. As these communities are strengthened, not only will they benefit immediately, but the global diamond trade will be less and less reliant on its connections to Russia.

7.

We have a fully traceable supply chain for our gold, which is single mine origin and we can say with 100% certainty does not contribute to conflict in any way. In fact, it creates access to finance to minority groups.

What you can do as a consumer

We like to believe the majority of consumers who wear diamond jewelry or gold jewelry, do care that the jewelry they cherish doesn’t contain the blood of Ukrainian citizens killed or tortured by Russian soldiers.

We believe this includes you.

The Global Gold Transparency Initiative has called jewelers to check their sources of gold by asking refiners and suppliers. Yet in an industry that relies on trust, few jewelers can truly be sure.

To be absolutely certain you’re not supporting Russian diamond and gold trades, ask your jeweler these questions:

Have you purchased any diamonds from Russian origin after Feb. 24, 2022?

No, we've stopped sourcing from Russia since February 24th, 2022.

We don't know the origin of our diamonds. But we can assure you they are conflict free in line with the Kimberley Process.

Yes, we continue to source diamonds from Russia.

Do you know which country the diamonds you purchased since were mined?

Yes, our diamonds are mined in [country] and [country].

(They’re supposed to tell you exactly which countries their diamonds were mined, ideally even where they were polished)

We don't know the origin of our diamonds. But we can assure you they are conflict free in line with the Kimberley Process.

Do you know where the gold you use was mined?

Yes. We have a fully traceable gold supply chain for our gold, use only FairTrade gold or use only FairMined gold.

No, we get our gold from a reputable seller.

No, we use recycled gold.

FAQ

Should I boycott diamonds?

You might be wondering if you should still buy diamonds if there’s such a high chance you’ll end up supporting the war. A boycott isn’t a viable alternative, since there are plenty of artisanal miners all over the world who mine diamonds for their livelihood.

It’s better to purchase your diamonds carefully and from known sources, like Australia, Botswana, Canada or Indonesia.

Should I buy lab created diamonds instead?

Lab created diamonds come with their own range of issues. You decide what matters to you, and you can decide whether a natural or man-made diamond suits your values more. We’ve made a quick overview for you to compare natural vs lab-created diamonds here.

Should I still buy gold jewelry?

Gold jewelry can still be a beautiful investment, with which you support small businesses and makers.

If you can, opt for gold jewelry that uses ethically sourced gold, like Gardens of the Sun mercury-free gold from indigenous women miners (fully traceable to the mine), FairTrade gold or FairMined gold. Recycled gold may still use Russian gold.